One-fifth of individuals now regularly consume non-alcoholic beverages due to the increase in sober curiosity and the availability of these products.

Customer experience (CX) platform DISQO released new insights about alcohol and non-alcohol consumption behaviors and sentiment in its new report, “Alcohol & Non-Alcohol Advertising.” DISQO outlines attitudes impacting the market and growth opportunities for brands looking to diversify from traditional alcohol beverages with non-alcoholic (NA) alternatives.

“Alcohol marketing is evolving rapidly,” said Patrick Egan, Director of Research & Insights, DISQO. “With budget-constrained consumers who are increasingly focused on health, our insights suggest that marketers should be intentional in their messaging. Whether that’s educating about differentiated offerings, touting unique production processes, emphasizing functional benefits or justifying higher price points, advertisers need to keep up with consumers in an increasingly crowded category.”

DISQO’s report helps brands understand how they can refine their messaging to reach a wider breadth of consumers with alcohol and non-alcohol alternatives, and to measure campaign impact holistically. Finding highlights include:

Traditional beverages reign supreme, but consumers want diverse options.

- Only 35% of consumers never drink alcohol; almost 20% drink beer at least weekly, and nearly 15% report the same for wine or liquor.

- As consumers trial non-alcohol options, traditional categories are seeing more constrained growth

Interest in non-alcohol alternatives is growing, but varies generationally.

- Top reactions to NA alternatives are curiosity (32%) and support (24%); Gen Zers (45%) feel curiosity at twice the rate of Boomers (27%).

- However, 15-20% of consumers are confused about the NA category, suggesting that education is still needed to win over hold-outs.

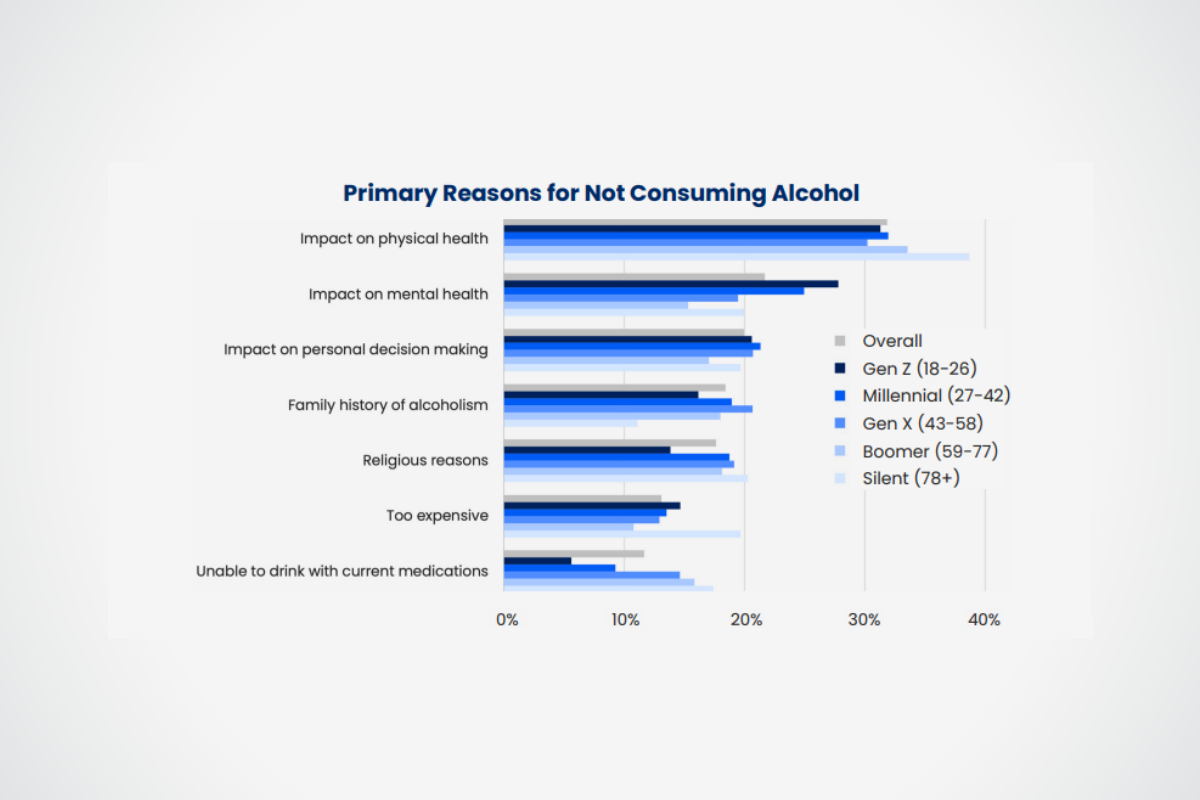

Health consciousness is driving market evolution.

- Over 20% of consumers cited alcohol’s impact on either mental health or physical health as their top reason for not consuming alcohol.

- Approximately 40% stated that they are trying to drink less, and about the same percent agree there should be clearer calorie counts on alcoholic beverages.

Price and experience drive consumption of alcoholic and non-alcohol beverages.

- Price ranks higher in importance for NA options compared to alcoholic options. This suggests that some may be dissuaded by the higher costs of NA beverages; over 25% think that NA alternatives should actually cost less than alcoholic options.

- NA options see less importance placed on brand name, offering new entrants an opportunity to gain market share. Preference for NA options is driven more by low calorie count and pairing well with food than are alcoholic options.

Data was sourced from 32,006 consumers in DISQO’s audience, June 5-6, 2023, and weighted to represent the US population.

Click HERE to download the “Alcohol & Non-Alcohol Advertising” report.

SOURCE: PR Newswire

PHOTO CREDIT: DISQO